A cash flow statement is a document that shows how much cash your business has generated and used over a specific period. It can be helpful for companies of all sizes, as it can give insight into where money is coming in and going out. This blog post will discuss a cash flow statement and how it can help you grow your business.

What is a Cash Flow Statement?

The cash flow statement shows the amount of money you have coming in and going out of your business each month. It includes cash from operations, sales of assets such as inventory or equipment; loans taken out for expansion projects like new buildings or equipment purchases; investments made into your company by shareholders; dividends paid to shareholders; cash used to pay bills, and expenses like utilities, phone service, rent or mortgage payments.

Suppose your statement shows that you’re making more money than spending. In that case, it indicates a strong cash position for growth and expansion opportunities. Conversely, suppose there’s less cash coming in than going out (negative cash flow). In that case, it means you may need to rethink your business strategy or cut back on certain expenses.

Structure of a Cash Flow Statement

A cash flow statement has three sections:

- Operating activities,

- Investing activities, and

- Financing activities

Operating Activities:

The first section, operating activities, includes cash receipts from customers and cash payments to suppliers. This section also includes cash generated from the production of goods and money paid for operating expenses such as rent, utilities, wages, and salaries.

Investing Activities:

In addition to cash from operating activities, the statement also includes cash from investing activities. These are cash flows related to investments such as buying or selling property, equipment, and securities.

Financing Activities:

Cash from financing activities includes money from issuing debt or equity and cash payments made to retire debt or equity. This section can help business owners understand how much cash is available to finance new investments or cover other expenses.

Negative Cash Flow vs. Positive Cash Flow

There are two types of cash flows in business: positive and negative. Positive cash flow means that more money is coming into the business than going out. Therefore, it indicates that the company is healthy and has a good cash flow. On the other hand, negative cash flow means more money is going out of the business. Therefore, the company is not doing well financially and needs to improve its cash flow.

Direct Cash Flow Method

The direct cash flow method calculates inflows and outflows of cash based on when they occur. It means that a business will consider all revenues and expenses if they’re earned or incurred in the same year.

Indirect Cash Flow Method

The indirect cash flow method calculates cash flow from operations by adjusting net income for non-cash expenses and changes in current assets and liabilities. The process starts with net income as its starting point. Next, items that do not involve cash inflows or outflows are added back to arrive at cash flow from operations. These items include depreciation, amortization, deferred taxes, and other non-cash expenses.

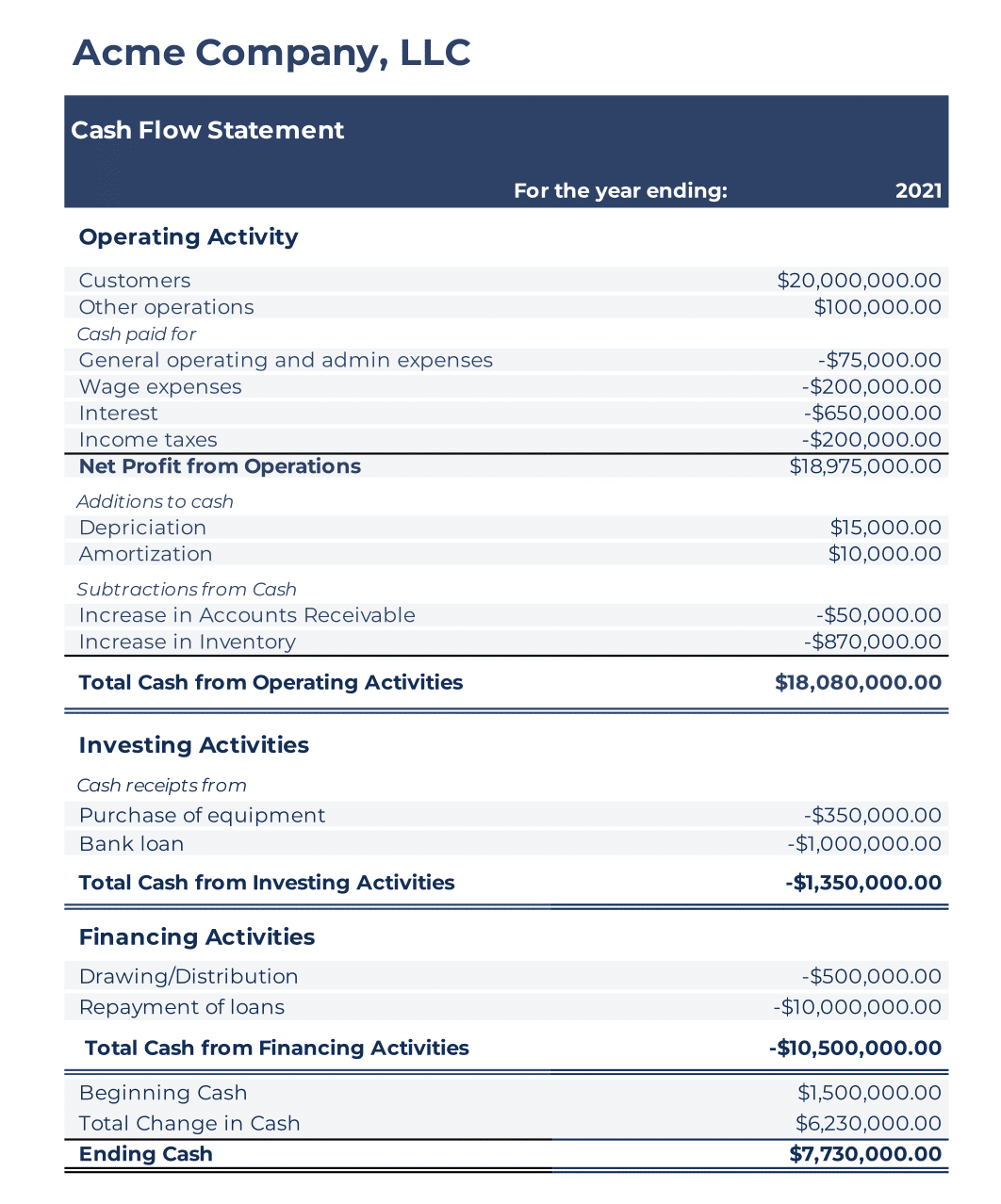

Example of a Cash Flow Statement

Here is an example of a statement for a fictional company.

Limitations of the Cash Flow Statement

There are some limitations to using the cash flow statement alone to measure a company’s financial health. First, the report does not present information about assets, liabilities, and stockholders’ equity like a balance sheet does. It also does not provide current information about the composition of cash flows like an income statement does.

For example, it isn’t easy to see whether a company’s increase in cash flow from operations is due to the rise in sales. Or if it has become more efficient at managing its expenses. Keep in mind that the cash flow statement is only as good as the income statement and balance sheet information. Therefore, it is essential to ensure that all three statements are accurate before making any decisions based on the cash flow statement alone.

Despite its limitations, a cash flow statement is a valuable tool for understanding a company’s financial health and should not be ignored when assessing its financial stability.