You know that cash flow is critical if you’re a business owner. It would be best to have a good handle on your cash flow to make sure your business is booming. But what is a cash flow forecast, and why does it matter? A cash flow forecast is simply a projection of your company’s future cash flows. This article will discuss the importance of cash flow forecasting and how it can benefit your business.

What is a Cash Flow Forecast?

A cash flow forecast, also known as a cash flow projection, is a tool businesses use to estimate their future cash inflows and outflows. Companies can use this information to make informed decisions about expanding operations or taking on new debt.

Several key factors go into creating an accurate cash flow forecast. The most important include:

- Historical sales data.

- Upcoming bill payments and expenses.

- Any projected changes in revenue or costs.

Business owners can better estimate how much money they’ll have available in the coming months and years by considering all of these elements.

How do I Create a Cash Flow Forecast?

There are multiple ways business owners can create an accurate cash-flow projection based on their current situation and needs. However, these methods differ widely depending upon what kind of resources each individual has at their disposal.

Two Ways to Create a Cash Flow Forecast:

There are two ways to make a cash flow forecast; one is the direct method, and the other is the indirect method. The direct method starts with your projected income statement and calculates your ending cash balance. The indirect method starts with your projected balance sheet and calculates your net cash flow from operating activities.

Whatever method you choose, you need to ensure that your forecast is accurate and realistic.

The Direct Method for Forecasting Cash Flow:

The direct method for forecasting cash flow does not rely on historical data, which may not reflect future conditions. Other forms of estimating cash flows typically use past results to predict future performance. For example, the direct method uses expected sales volume and selling prices of products or services, direct costs incurred in producing those goods or services, overhead expenses such as rent and utilities, and interest payments on any outstanding debt.

- The first step in cash flow projection using the direct method is to estimate cash receipts. It involves evaluating the cash coming in from sales of products and services, fewer returns, and allowances.

- The second step is to estimate cash payments, which involve all cash outflows other than principal debt payments. These cash outflows include items such as operating expenses and capital expenditures.

A key advantage of using the direct method is its ability to capture changes in working capital—the cash balance on an average day. It is crucial because fluctuations in working capital can significantly impact cash flow.

The Indirect Method for Forecasting Cash Flow:

The indirect method of cash flow projection is a more realistic way of predicting future cash flow. This method takes into account past cash flow, as well as current and future business trends. The indirect method is also less susceptible to estimation errors.

The first step in cash flow projection using the indirect method is to calculate cash inflows and outflows for each period. Businesses can do it by reviewing past financial statements, current sales projections, and other known factors affecting cash flow. Once the cash inflows and outflows are calculated, they are totaled to get a net cash flow figure for each period.

The final step in cash flow projection is to forecast total net cash flows over the desired period. A company can do it by deducing from the figures calculated in the previous step or using software programs designed specifically for this purpose. The results of this analysis can provide business owners with valuable insights into cash flow trends that may affect their future financial success.

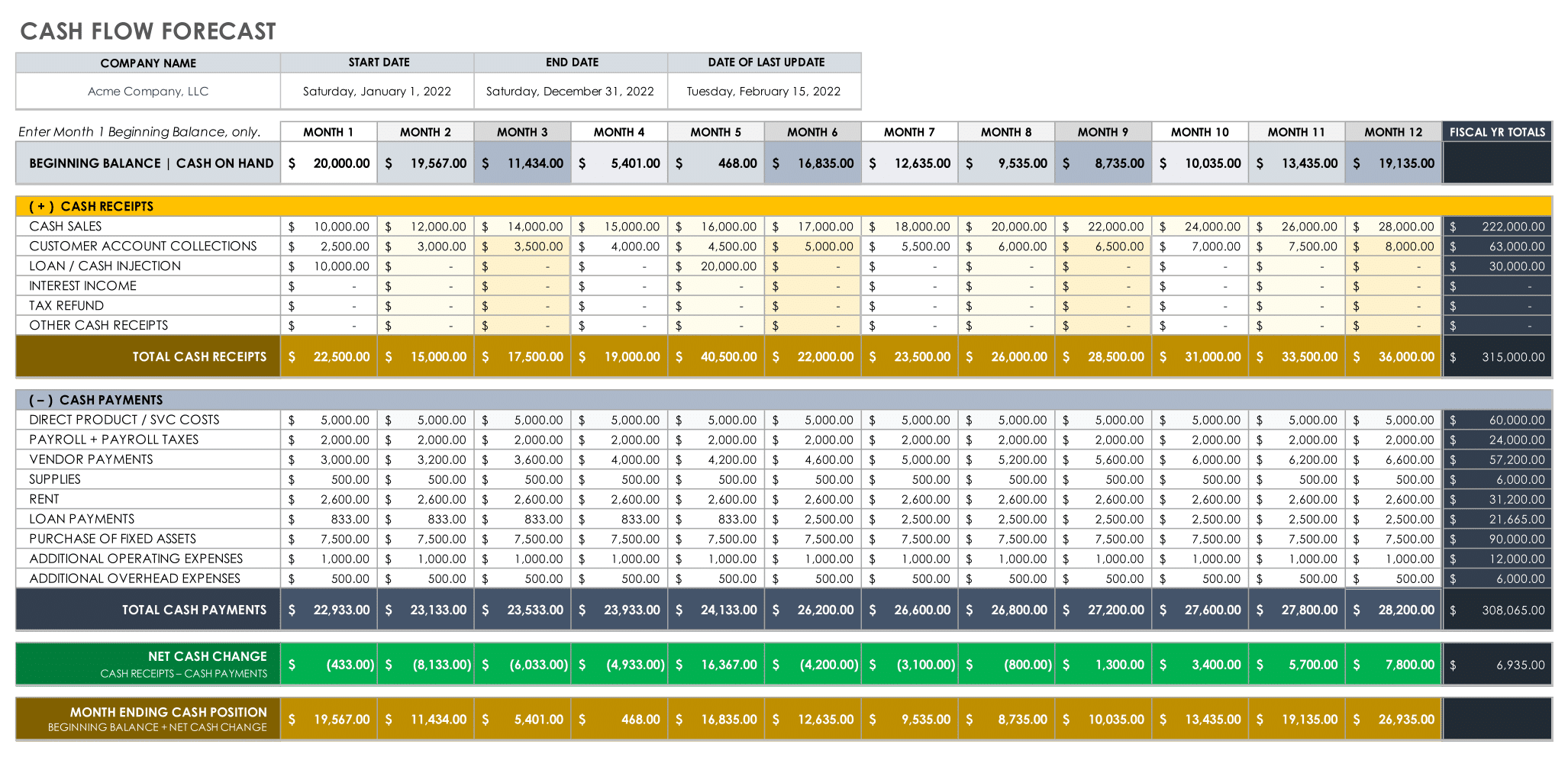

Example of a Cash Flow Forecast

Be Realistic with a Cash Flow Forecast

When creating your forecast, you should be realistic and consider any potential bumps in the road. It means considering if any significant events could affect your cash flow, like seasonal spikes, reduced activity, or invoices you need to payout. These will impact what money is coming in and going out and how much cash you’ll have on hand.

Benefits of a Cash Flow Forecast

A cash flow forecast can help you make plans for the future and make informed decisions about your business. It allows you to see how much cash will be coming in and out of your company so you don’t run into financial trouble down the road.

If done correctly, this type of planning can prevent overspending or taking on too much debt. It will also allow you to take advantage of opportunities when they arise.

Here is a list of the benefits:

- Anticipate future cash needs and make better decisions about when and how to borrow money.

- Plan for seasonal fluctuations in your business’s income and expenses.

- Make informed choices about pricing, investments, and other strategic decisions.

Once you’ve created your cash flow forecast, it’s important to revisit it regularly and make changes as needed. The goal is to have a cash flow forecast that helps you make important decisions, ensuring the long-term success of your business.