You may ask yourself what is a balance sheet if you are thinking of starting a business. The balance sheet is a financial document that uses the accounting equation to show what a company owns (assets), what it owes (liabilities), and what value remains to be claimed by shareholders (equity).

The formula is Assets = Liabilities + Owners’ Equity

The statement is used to measure a company’s financial health and help you decide about growing your business.

What is the Purpose of the Balance Sheet?

With the income statement and cash flow statement, a balance sheet is an essential tool for investors, creditors, and business owners to gain insight into a company and its operations. It presents what a company owns or what it owes (assets and liabilities) and the company’s ownership (equity).

What are the Parts of the Balance Sheet?

The three significant pieces are assets, liabilities, and equity.

Assets include:

- cash (in banks or on hand)

- accounts receivable (money owed to you)

- inventory

- investments such as stocks and bonds

- property and equipment

- other assets such as patents and trademarks

Liabilities include:

- accounts payable (money you owe others)

- lines of credit

- mortgages and other loans

- deferred revenue (money you’ve received but haven’t yet earned)

- other liabilities such as notes payable

Equity includes:

- common stock

- paid-in capital

- retained earnings

- treasury shares

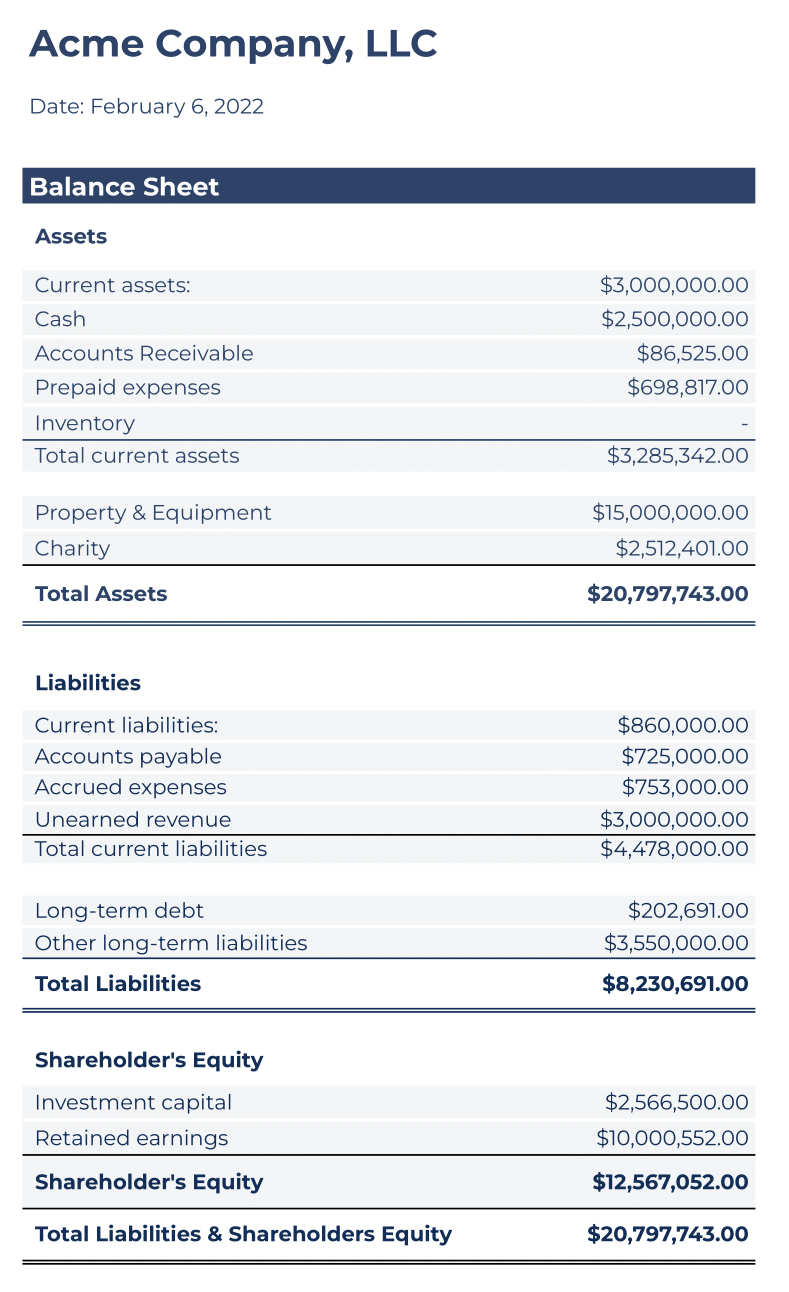

Example of a Balance Sheet

Here is an example from a fictional business.

How to Create a Balance Sheet

To create your balance sheet, you first need to list all your company’s assets. It includes cash, accounts receivable, inventory, and anything else of value your company owns. Next, you need to list all of your liabilities. It includes accounts payable, loans from banks or other lenders, and any additional money you owe. Finally, you subtract your liabilities from your assets to calculate your equity. Your equity is the amount of money that belongs to the company’s owners. It represents the net worth of the business.

How to Analyze a Balance Sheet

Analyzing a balance sheet is a great way to understand how healthy your business is. A company can prepare it at any time. It allows for easy comparisons between periods and helps identify trends in both assets and liabilities.

By analyzing the data, you can get a good idea of your business’s financial standing and make informed decisions about investing and growing your company. For example, if you see current liabilities are high compared to assets, this may show your company is not generating enough cash flow and needs additional financing.

Balance vs. Unbalanced Sheet

A balance sheet is balanced if these components are equal (assets = liabilities + equity). It means that everything on one side must match something else on the opposite side, so there’s no imbalance between assets or liabilities and shareholders’ equity. But sometimes, things don’t always stay this way, and you’ll get an unbalanced sheet, and you’ll need to balance it to get accurate information from it.

Why is a Balance Sheet so important?

It is essential for many reasons, including:

- It provides information about the assets, liabilities, and equity of a business.

- Financial analysts can calculate ratios that help assess the performance of a company.

- They include accounts in other essential financial statements, such as income and cash flow statements.

Relative Size Analysis: You can use balance sheet analysis to determine the relative size of your business compared with other companies in the same industry. It is beneficial to compare different companies to understand better which company is more competitive than others or vice versa.

Liabilities/Asset Ratio: Another way analysis uses the balance sheet is to calculate the asset/liabilities ratio, which shows how much money a company owes versus its total assets (including cash). It’s important because it gives investors insight into what percentage of their investment will go toward paying off debt rather than building up new assets over time, thus ensuring that they’re not getting burned in the long run.

Debt/Equity Ratio: Finally, a business can analyze debt versus equity. It shows what percentage of total assets (including cash) are tied up with obligations such as loans or mortgages while also showing how much money is available for investing in new ventures or other opportunities.

Who looks at the Balance Sheet?

Creditors look at a balance sheet to see if the company is creditworthy, while regulators look at it to see if it is following regulations. Finally, shareholders look at it to decide if they should invest in the company or not.

Do Balance Sheets Have Limitations?

Yes. Like all financial statements, they have limitations. They provide a snapshot in time and do not tell the complete story about a company’s health over an extended period or how it got to today. Additionally, they do not always include off-balance-sheet liabilities like operating leases that could impact what creditors look for when deciding to lend money to a business or not.

For example, suppose your company rents office space from another company every month but does not own its building. In that case, you probably have an operating lease liability on your sheet which will affect calculations like working capital (current assets – current liabilities) and debt-to-equity ratio (total liabilities/shareholders’ equity). Unfortunately, they don’t always include these liabilities, so calculations based on these data may not be accurate.

The Balance Sheet and Taxes

If you are a C-corporation, balance sheet reporting is required for tax purposes. Also, small corporations with total receipts and assets less than $250,000 are not required to do this either. If you are a sole proprietorship or LLC, the IRS does not require it, but you might have to include them with other financial statements to bankers, lenders, or investors.