The income statement (profit & loss) is a crucial financial document for businesses. This document shows how much revenue your company has generated over a specific period and the expenses incurred during that same period. By reading and interpreting this statement, you can get a clear picture of your business’s financial health. This article will discuss what the statement means, how to read it, and what different terms mean. Let’s get started!

What is an Income Statement?

The income statement is a document that shows how much money a business has earned over a specific period. The report includes revenue and expenses and can track a company’s profitability over time.

Understanding the Income Statement

The income statement gives you insight into how profitable companies are and whether their investments in these companies will be worthwhile. While a balance sheet provides the snapshot of what a company owns and owes at a particular time, an income statement provides the income and expenses that occurred over the year.

We divide the income statement into four sections: revenue, cost of goods sold (COGS), gross profit, and operating expenses. Each unit is essential in understanding the statement as a whole.

Here are some items you should pay attention to:

Revenues

The statement starts with revenues, the total amounts of money a company has earned during a specific period. This revenue can be from sales of products or services, interest income, dividends, or any other type of income.

Operating Revenue: Next on the income statement is operating revenue. The operating revenue measures the company’s income from regular business activities, such as sales of products or services. It excludes income unrelated to the company’s normal operations, such as investment income or gains.

Non-Operating Revenue: Non-operating revenue is a company’s income from investments or other non-core business activities. This section often includes income from investment securities, such as bonds and stocks.

Gains (Other Income): Other income comes from non-sales activities. This income may include interest income, rental income, or revenue from licensing an item to another company.

Expenses and Losses

After revenues come expenses, these are all the costs incurred to generate revenue. We separate costs into several categories, but the most important ones to consider are:

Cost of Goods Sold (COGS): This amount is what a company pays to produce its goods or services, including direct labor and materials.

Selling, General & Administrative Expenses (SG&A): These are all the costs of running a company, such as marketing and advertising, rent, utilities, and employee salaries.

Depreciation and Amortization: This is the amount that a company writes off its assets over time (usually monthly or yearly). For example, if a company buys a new machine for $50,000, it might depreciate that machine by $5000 each year for the next ten years. This expense reduces a company’s taxable income.

Research and development (R&D) Expenses: These are the costs associated with developing new products or services.

Loss on Sale of Assets: This is the loss a company takes when it sells an asset, such as a building, for less than it paid for it. The most common type of loss is a net operating loss when expenses exceed revenue. A net operating loss can carry over to future years, which can help reduce your tax bill.

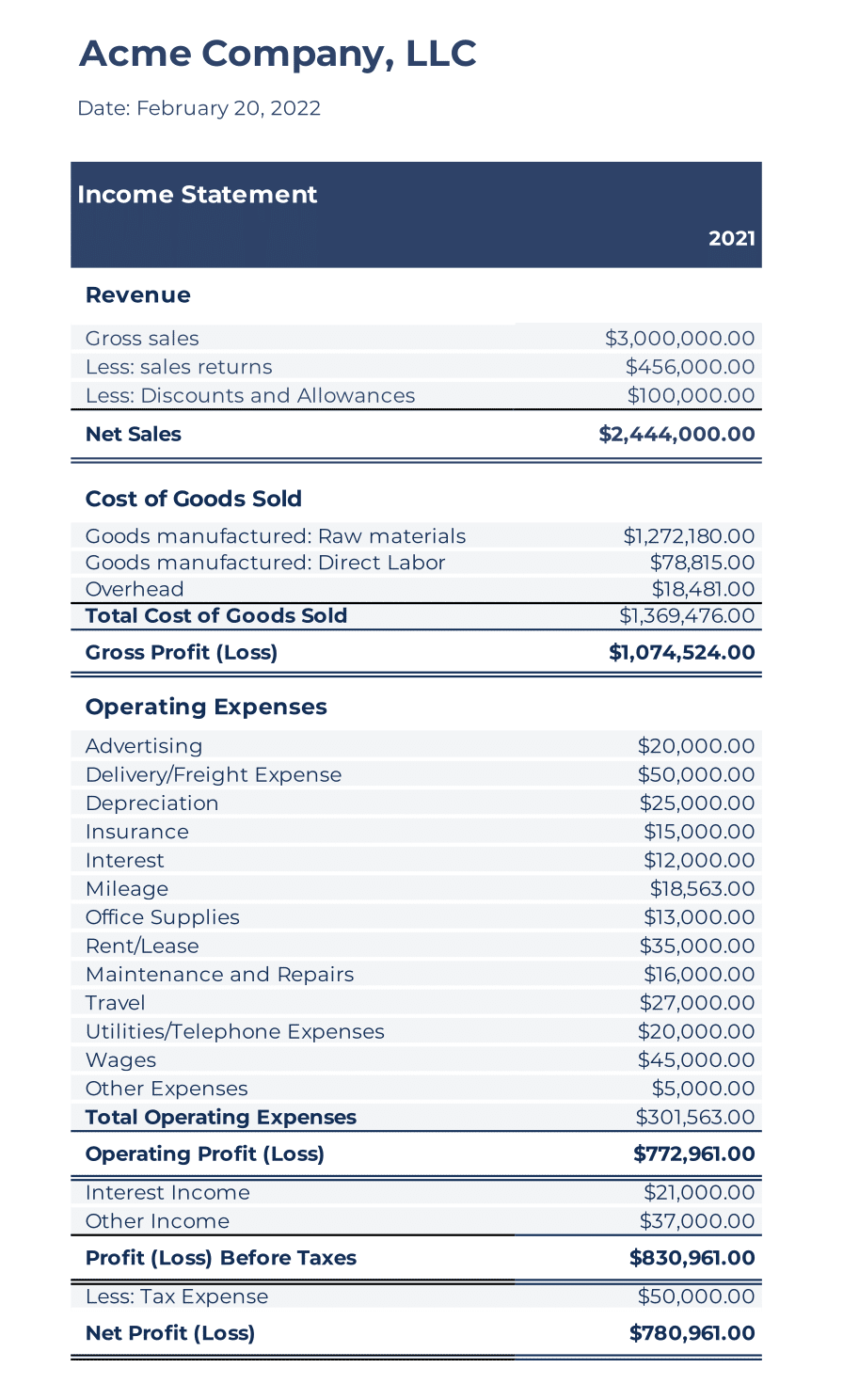

Income Statement Example

The income statement contains vital information to help you identify revenue, costs, and profitability trends. Here’s an example:

What is a Multi-Step Income Statement?

A multi-step statement is a financial report that shows the income and expenses over a specific period. It breaks down revenues and costs into categories to see how much money is earned and spent on different expenses. This information can help you understand a company’s profitability and make informed investment decisions.

What is a Single-Step Income Statement?

A single-step statement summarizes a company’s income and expenses for a specific period. First, it shows the total revenue earned and the total costs incurred. This statement does not break down payments and costs into their respective categories (such as sales, cost of goods sold, and administrative fees).

What is a Common-Size Income Statement?

A common-size statement shows every line item as a percentage. This percentage makes it easier to compare how much each income source and expense category contributes to its total income. For example, suppose you see that cost of goods sold accounts for 20% of total revenue. This could show that your profit margin might be lower than average because of expenses on raw materials.

Who uses Income Statements?

Management and investors typically use income statements. For example, a company’s statement is often one of the first sections of a company’s annual report an investor will examine before making an investment decision. In addition, lenders, creditors, and banks review these statements.

Here are other uses:

- To compare the income and expenses of two or more companies

- To calculate ratios that measure a company’s liquidity, solvency, and profitability

- To assess the financial performance of a company’s management

Income Statement vs. Balance Sheet

The difference between an income statement and a balance sheet is that an income statement focuses on a company’s income and expenses. In contrast, the balance sheet summarizes the assets, liabilities, and shareholders’ equity in time.

Why use an Income Statement?

The reason for using an income statement for your business is to track income and losses over a period. You can use it to help make sound financial decisions for your company. Without it, you may not be fully aware of what is happening with your business financially. As a result, you can cause your business to fail. Don’t let that happen to you.