A bad debt expense is an overdue invoice (receivable) you know won’t get paid. So now it’s time to write off the bad debt so you can have an accurate picture of your business finances.

In this guide, you’ll learn:

- What is a Bad Debt Expense?

- Direct Write-Off Method

- The Allowance Method

- Percentage of Sales Method

- Percentage of Accounts Receivable Method

- Aging of Accounts Receivable Method

- Writing Off Accounts

When you sell any product or service on credit, always expect that some sales will not get paid. Once you know this for a fact, you will need to record (write-off) the sale as a bad debt expense. Writing off the debt helps you avoid overstating your finances.

I had a client who did not know he needed to write off his bad debt every year. When he started the next year of bookkeeping, his books always showed more income than he took in, and he had to pay taxes on this income.

Once I explained how vital writing off a bad debt was, we could get his finances back in order and save him money.

Recording Bad Debts

There are two ways to record bad debt:

- Direct Write Off Method (aka Specific Write-Off Method)

- Allowance Method

Direct Write-Off Method

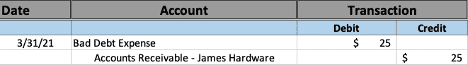

The direct write-off method is best for small, occasional bad debts. First, you will need to adjust your journal entry to do the direct write-off method. Then, remove the bad debt from your receivables and add it to an expense account called “Bad Debt Expense.”

The direct write-off method is simple and does not need estimation. It causes no significant errors if the amounts are small.

Keep in mind the direct write-off method does not follow GAAP and the matching principle. The direct write-off method means we record expenses and related revenues simultaneously it happens. To follow GAAP, you must use the allowance method instead.

Allowance Method

The allowance method uses an imaginary bucket of cash called a contra asset account. A business then uses this to pay off bad debt as they occur during the year. A contra asset account estimates bad debt, which a company expects every year.

The allowance method involves two parts:

- Estimate the number of sales or receivables that will not be collectible

- Use a contra asset account to deduct from accounts receivable

The three methods for estimating bad debts when using the allowance method are:

- Percentage of Sales Method

- Percentage of Accounts Receivable Method

- Aging of Accounts Receivable Method

It doesn’t matter which method you use, as long as you calculate your estimate to help you write off amounts in the following sections.

Percentage of Sales Method

Step 1:

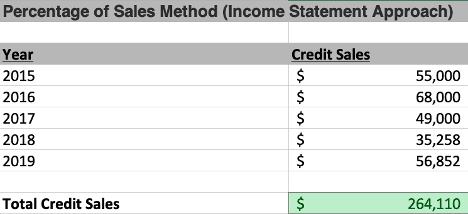

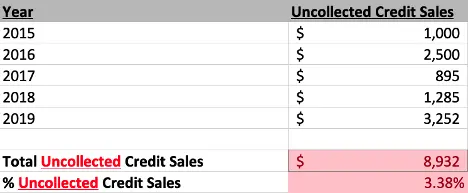

To use the percentage of sales method, you will need to know your credit sales. Credit sales are the sales you make on credit, not in cash. You can find this on an income statement.

If you can’t find your credit sales on your income statement, you can calculate them using the formula below.

Credit Sales = Total Sales – Cash Sales

For example, let’s say your business generated $50,000 worth of sales, and $25,000 of that was cash sales. Credit sales, in this case, would be $25,000.

You should calculate your credit sales for at least 3 to 5 years.

Once you know your credit sales, you can go to the next step.

Step 2:

You need to figure out how many sales were uncollectible for each year. Once you have this information, download this Google Sheet and plug in all your data. The Google sheet will calculate your total uncollected credit sales and their percentage.

Percentage of Accounts Receivable Method

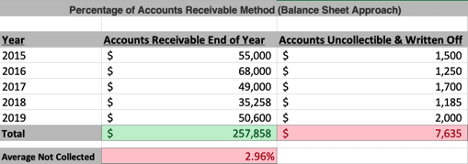

This method looks at the balance of accounts receivable and the total bad debts at the end of the year. Then, you divide the totals, calculating an average you can use to estimate future bad debts. I have included a Google sheet to help you.

Aging of Accounts Method

This approach is like the percentage of accounts receivable, but it looks at how long it takes customers to pay. A general rule is that the longer an account receivable remains unpaid, the more it will default.

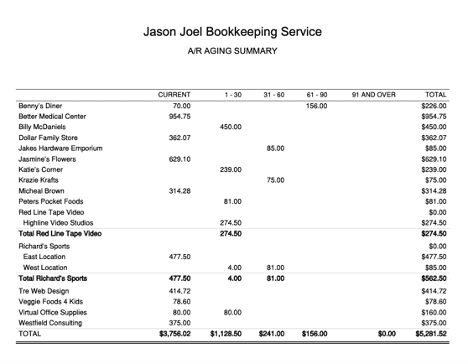

To start, you will need to have an aging accounts receivable report. Here is a sample report:

Usually, accounting software can generate this report for you. Once you have this report, you can download a Google sheet I made to help you estimate your bad debts.

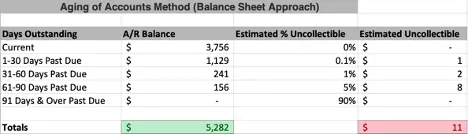

You need to add the totals for each column to estimate the amounts. I filled out the worksheet with my data, which was estimated $11.

You can see from this example if I sold $1,000 of products on credit, $11 of that total might become bad debt.

Writing Off Accounts with Allowance Method

Let’s imagine on December 31, 2020, you made $50,000 in credit sales, and you estimated 3% ($1,500) of those sales would go wrong. But, of course, you don’t know how many of your customers might not pay, so that you will do the following journal entry:

Now let’s say on April 5, 2021, you realize one of your customers, James Hardware, will not pay you the $500 they owe. So you make the following journal entry:

This journal entry reduces the Allowance for Doubtful Accounts to $1,000, and now James’ account is written off.

Recovery of Account (Allowance Method)

On June 30, 2021, let’s assume that James will pay the invoice written-off. To record his payment, you need to reverse the transactions in a journal entry:

Writing off bad debt is an essential step in accounting. Understanding bad debt will keep your financial records in order and help you avoid overstating your income. It will also give you insight into your customers’ payment patterns and if you should revise your credit policies.