Are you overwhelmed by financial statements and all the jargon that comes with them? As a startup founder or CEO, it’s essential to have a clear understanding of financial statements. In this guide, I’ll break down the basics of the three fundamental financial statements and how you can use them to make informed business decisions.

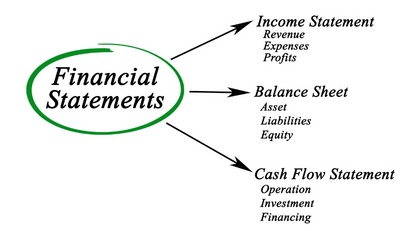

Let’s start with an overview of the three primary financial statements:

- Balance Sheet: This provides a snapshot of your company’s financial position at a specific time. It includes your assets, liabilities, and equity.

- Income Statement: This statement shows your company’s revenue, expenses, and net income over time.

- Cash Flow Statement: This statement tracks your startup’s cash in and out over a particular period.

Now, let’s dive deeper so you can get a better understanding of these financial statements:

The Balance Sheet

Simply put, a balance sheet is a financial statement that provides a snapshot of your company’s financial position at a specific time. It shows the assets, liabilities, and equity of your business.

Assets:

Assets are the resources that your company owns, which can be tangible or intangible. When I say tangible, I mean assets such as cash, inventory, and property. Intangible assets include patents, trademarks, and copyrights.

For a startup, some examples of assets include software licenses, servers, intellectual property, and research and development investments. The value of your assets is critical for your startup’s financial health, as it can help you assess your company’s ability to generate revenue and fund future growth.

Liabilities:

These are debts that your company owes to others, including creditors, suppliers, and lenders. Liabilities include accounts payable, business loans, and taxes owed.

For startups, liabilities include loans to fund research and development, outstanding supplier payments, and legal expenses. Keeping an eye on your liabilities is critical. They can affect your company’s financial health and ability to take on future debt or equity investments.

Equity:

Equity is the value of your company that belongs to the owners, shareholders, or investors. It’s the difference between your company’s assets and liabilities.

For a startup, equity might come from the initial investment from founders or angel investors. Then, as the company grows, equity may come from venture capital funding or an IPO.

Using Your Balance Sheet

One way to use your balance sheet is to analyze your current financial position and identify areas for improvement. For example, suppose your liabilities exceed your assets. In that case, you may need to cut costs or raise additional funds.

Another way to use your balance sheet is to monitor your company’s financial progress over time. For example, you can see your company’s growth and improvement by keeping track of your assets and liabilities.

Finally, the balance sheet can help you make strategic decisions. For example, imagine you’re considering securing more debt or equity investments – to increase your chances of attracting potential investors, you’ll need to ensure your balance sheet is appealing.

The Income Statement

Now, let’s understand the different parts of an income statement and its purpose.

Revenue: This is the total cash your company brings in from sales. Revenue represents the income your company generates from selling its products or services.

Expenses: These are the costs your company incurs to generate revenue, such as salaries, rent, utilities, and marketing expenses. Expenses represent the money your company spends to keep the business running.

Net Income: Your company’s profit or loss after subtracting expenses from revenue.

Using Your Income Statement

Now, let’s talk about why your income statement is so important. You can use this report to help you identify trends in revenue and expenses and make informed decisions about optimizing your spending to increase profitability.

Let’s take a look at an example to illustrate this point:

Say you run a tech startup that sells a SaaS product. In the first quarter of the year, your company generates $100,000 in revenue and incurs $70,000 in expenses.

Your income statement would look like this:

Revenue: $100,000

Expenses: $70,000

Net income: $30,000

Now, let’s say you analyze your expenses and find that your marketing expenses are higher than anticipated. By reducing marketing expenses and reallocating those funds to other areas, such as product development, you can increase revenue to $120,000 in the second quarter while keeping costs at $65,000.

Your income statement would now look like this:

Revenue: $120,000

Expenses: $65,000

Net income: $55,000

Notice how the increase in revenue and decrease in expenses led to a significant increase in net income. By regularly analyzing your income statement and identifying areas where you can reduce costs and increase revenue, you can make decisions to grow your startup’s profitability.

Cash Flow Statement

Finally, we’re at the cash flow statement. Let me break down the three sections of this statement and show you how to use them to make better decisions.

Operating Activities:

The first section of your cash flow statement is operating activities. This section displays the cash inflows and outflows from your company’s day-to-day operations, such as sales and expenses.

For startups, this section might include cash inflows from subscription revenue. On the other hand, cash outflows consist of expenses such as salaries, rent, and marketing costs.

Investing Activities:

The second section of your cash flow statement is investing activities. This section shows your company’s investments’ cash inflows and outflows, such as property, equipment, or stocks.

For startups, this section might include cash inflows from investments in new software or research and development projects. On the other hand, cash outflows consist of expenses related to acquiring new equipment or purchasing a patent.

Financing Activities:

The final section of your cash flow statement is financing activities. This section indicates the cash inflows and outflows from your company’s financing activities, such as loans or issuing stock.

For startups, this section might include cash inflows from loans or investments from venture capitalists. On the other hand, cash outflows consist of expenses related to paying off loans or issuing dividends to investors.

Using Your Cash Flow Statement

Understanding your cash flow is vital for your startup’s financial health and success. When analyzing your cash flow statement, you can identify areas where your company generates or loses cash. You can use this information to make intelligent decisions about allocating resources and planning for future growth.

For example, suppose your cash flow statement shows that your company is generating more cash from its operating activities than its spending. In that case, it’s a positive sign that your company’s operations are profitable. Consider investing more in these areas to help your startup grow.

But suppose your cash flow statement shows that your company is spending more on investments and financing activities than it’s generating. In that case, it’s a warning sign that your company might struggle to fund its growth. In this case, you should reconsider your investments or look for new financing options.

Final Thoughts

As a startup founder or CEO, understanding financial statements is necessary to get invaluable insights into your company’s financial health and help you make decisions about allocating resources and planning for growth. So, take the time to learn about these financial statements and use them to your advantage.