Reconciliation is an accounting term that means matching two sets of records. For example, bank reconciliation refers to comparing the balances provided by the bank statement against your business’s cash balance figure. Learning how to do a bank reconciliation for small businesses protects you from theft or fraud.

Importantly, reconciliations help you eliminate accounting errors, mistakes, omissions, and non-compliance. As a result, it can help your business with financial compliance and build a firm foundation for accurate financial reporting.

Most small businesses keep their accounting records on paper books. Even if your company has accounting software, you’ll need to reconcile the accounting records against the bank statement.

Let us walk you through a bank reconciliation and how to perform it.

What is a Bank Reconciliation?

Bank reconciliation is matching the bank statement against the cash balances of your ledger account. The ending balance of a bank statement and ledger account balance should always match. However, that is rarely the case.

Even if you keep the bookkeeping records up-to-date, you’ll find some sorts of discrepancies that need to be corrected. Overall, bank reconciliation is finding and fixing these discrepancies. Reconciling will help your small business in a multi-faceted way from compliance, reporting, and analysis.

How to Do a Bank Reconciliation for Small Businesses?

A small business owner, bookkeeper, or accountant can perform bank reconciliation, but it is advisable to have a professional handle all accounting records to avoid errors.

Before you begin:

You can start by gathering basic accounting information such as month-end accounting reports. Gathering relevant accounting information and statements beforehand will help you complete the process smoothly.

Step 1: Compare the Cash Balances

You’ll need to first match the ledger balances with the bank statement for the same period. For example, let’s say you want to reconcile on July 2021. You can start by comparing the bank account’s end balances and the ledger’s cash accounts. If these balances match, you can skip the exercise. However, there can still be discrepancies, such as missing out on both records’ transactions. Double-check if you are not sure.

Next, track the cash entries on the bank account statement and match them against the ledger entries.

Step 2: Adjustments for the Bank Account

There will be several entries that do not show in the bank records immediately. For instance, your uncleared check deposits may take some time to receive funds. Similarly, your accounts receivable wouldn’t match the bank records.

You should first adjust the bank statement for such delayed accounting entries. These entries must include the cash-in-transit as well. Similarly, it’s time to correct any bank account charges, commission, or interest costs with the bank.

Step 3: Adjusting the Cash Account in the Ledger

This step will continue simultaneously with step two above. Just as you record accounting adjustments for a bank statement, you’ll notice the same for the ledger as well.

The ledger will need adjustments for commission, uncleared deposits, and non-cash items, if any. In addition, you may find some non-sufficient checks on hold, like account receivables or cash-in-transit. Banks hold these checks if there are no sufficient funds available in your bank account and clear them as soon as you deposit funds.

Step 4: Review and Repeat if Necessary

Recording missing entries and corrections in both records should now give the same balances. However, there can still be a chance of error. It can happen due to wrong checking amount entries by the bank clearing system or skipping a complete transaction at all.

You can review each transaction against the physical record receipts at this stage. It will ensure it accurately records all checking entries in the ledger and bank statement. If you still can’t match the balances, you should thoroughly repeat the reconciliation process.

Example of Bank Reconciliation

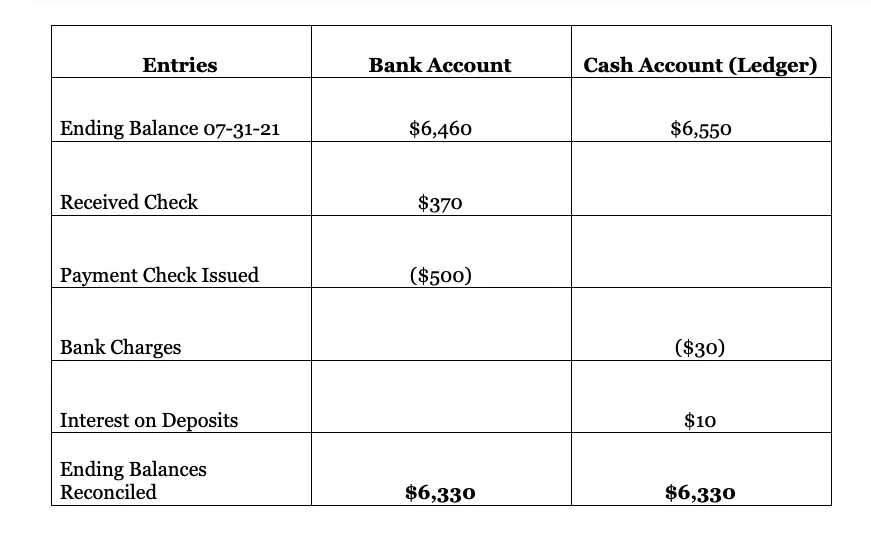

Suppose your small business had a ledger balance of $6,550 as of July 31, 2021. You issued a check of $500 for a supplier payment, and you deposited a check of $370 from a client. Your Bank account balance does not match the ending figure of $6,550.

Both checks wouldn’t reflect in the bank statement before clearance through ACH. Also, the bank charges and interest earned wouldn’t remember in the ledger. After recording these entries in the relevant accounts, the reconciliation would be like this:

Importance of How to do a Bank Reconciliation for Small Businesses

Bank reconciliation serves several purposes for a small business. Accuracy of the accounting records is the apparent benefit because errors in your accounting records can lead to problems when filing taxes, which can be expensive and time-consuming to correct.

Here are a few essential benefits of performing bank reconciliation for your small business.

Fraud Prevention

It’s better to prevent fraud rather than detect it. Performing reconciliation means you’ll catch any wrongdoings from employees, vendors, and customers. In addition, it will create discipline and a sense of accountability among your staff, preventing fraud or theft.

Accuracy of Accounting Records

The accuracy of accounting records is the apparent benefit of bank reconciliation. It will also help you detect any errors or omissions on the bank side.

Compliance

Accurate accounting records mean compliance with regulatory requirements. In addition, accounting records set the foundation of a solid financial segment for any business. Thus, leading you to reduce audit and tax errors that could impose hefty fines and penalties.

Help in Cash Flow Management

As you verify each cash entry, it will help your small business to manage the cash flow. You’ll be able to identify unnecessary cash expenses and help you plan how to use your cash more effectively.

Reporting and Analysis

You’ll track each cash transaction. It means you can use the process for reporting and analysis to turn raw data into valuable accounting information that will give a productivity boost to your small business.

How often to Perform Bank Reconciliation for a Small Business?

Large businesses have dedicated accounting departments; thus, they reconcile bank statements daily. As a small business owner, make it necessary to perform reconciliation every month.

Top Tips for Efficient Bank Reconciliation

Here are our top tips for efficient bank reconciliation for your small business.

- Verify the reconciliation period and dates for both accounts.

- Double-check the beginning and ending balances for the same period.

- Verify transactions from the bank statement and match them against checks.

- Keep accurate and up-to-date bookkeeping records for consistency.

- Watch out for numerical errors and mistakes.

- Carefully evaluate the missing ledger accounts and double entries for similar amounts.

- Record the adjusting entries in the relevant accounts immediately.

- Follow an accounting method, such as accrual or cash, for the entire accounting period before switching to another.